The digital transformation of logistics is in its infancy and offers a host of opportunities for further development.

According to a new study by Lux Research, the transportation and logistics industry requires digital transformation tools to expedite and personalize delivery, while reducing emissions.

The industry is already innovating around these three challenges, with technology startups and incumbents like Microsoft, IBM, and SAP building solutions specifically for logistics.

SEE ALSO: Chemicals, Materials Industries Next in Line for Digital Transformation

“Trade globalization, digital consumers, and low oil prices have all driven growth in the transportation and logistics industry while imposing new challenges,” said Lux research analyst, Harshit Sharma. “For example, there is growing consumer demand for agility through the rapid delivery of products: Air cargo is the best means to achieve this but decreases sustainability significantly due to air freight’s high carbon intensity, not to mention that rapid delivery can also mean often engaging with new vendors, creating visibility challenges.”

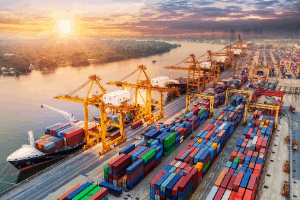

Even if air cargo takes some market-share away from container shipping, it is still expected to be the primary way to deliver goods. However, Lux believes that in the future, e-commerce companies may absorb courier and freight businesses, to build a competitive edge.

Amazon has already begun its own delivery operations in the U.S. and has its own air cargo service, but it still works with third-party suppliers. In the future, we may see Amazon, Alibaba, and JD.com look at consolidating the market, through acquisitions.

“Currently, the digital transformation of logistics is in its infancy and offers a host of opportunities for further development. Technology development is primarily being led by innovative startups like FarEye, ClearMetal, and Optoro and not by industry service players, which is in stark contrast to many adjacent industries, including oil and gas, chemicals, and power,” said Sharma.

Logistics companies that remain independent may look at reducing their assets, as they transition to service-based business models. This could mean a business like DHL or Maersk reduces its fleet size to reduce capital and operational costs, earning revenue strictly from software and services.