Every transaction, order, customer interaction, and internal operation depends on decisions. At a time when businesses are under pressure to improve efficiencies, cut costs, and be more responsive, automating decisions becomes essential. While many businesses have picked off the low-hanging fruit when automating, most need to add more. Specifically, businesses want to automate complex decisions, involving multiple steps, multiple data sources and many rules.

Therein lies a problem. Automating simple decisions typically involves very narrowly defined operations. They may involve a database lookup call to retrieve data, some analysis of the data, and the execution of a standard action that is applied to all cases. For example, a financial institution might try to prevent theft by verifying a customer’s account credentials and balance before processing a large transaction.

Scaling required

In this example, the basic approach of checking the customer’s ID and balance no longer offers much protection due to the growing sophistication of cyber-thieves. Now, a bank might want to conduct a threat analysis of every transaction to make a real-time decision before letting the transaction proceed. That process would examine streams of data from multiple sources and use advanced analytics based on machine learning or artificial intelligence.

Automating the go- or no-go decision requires bringing together multiple systems, data sets, and analysis routines. Doing this once is challenging enough. But it is very likely that this system would need constant updates. It would need to include new data for different systems as it became available and new analysis algorithms as needed over time.

Breaking free from the restraints of traditional methods

Similar complexity is found in other applications where companies attempt to automate decisions. The problem most find is that many decision automation efforts are limited to tightly knit applications that run locally. In the past, that may have been enough. But modern business applications today are:

- More commonly loosely coupled and distributed

- Deployed on-premises and on private and public clouds

- Integrate third-party elements that are critical to the final decision

For example, when approving a customer for a loan, a bank would most likely use a third-party credit worthiness service rather than develop their own.

Another factor that greatly impacts decision automation is the dynamic nature of business today. A business might want to factor in the information from a new data source or use a different analysis algorithm to come to a decision. It might want to run the discrete elements that help automate decisions on a different platform to get the needed performance or comply with cost constraints.

How decisions are made may also change. The COVID-19 pandemic has shown how easily disruptions can upend operations and financial decisions. Factors that in the past were considered important may be moot or worthless and now must be replaced with other considerations when making a decision. For example, credit risk decisions are operating in a completely new domain as the impact of the virus started taking its toll on businesses.

Accommodating these factors requires constant updates

to the software and systems used for decision automation.

Like many other business areas where applications are used, decision automation solutions must be rapidly developed to meet new demands. They need the agility to be frequently modified, updated, and to make use of new data and analysis methods.

Making efficient use of developer resources

Businesses need an approach that optimizes the use of developers’ time while affording the agility and speed to meet changing market needs. They also need agility to be responsive as things change. Intelligent decision automation requires at a minimum that ability to separate decisions from business applications.

Many businesses are turning to development processes with a more business-friendly approach and more iterative feedback loops to constantly improve and update an application. A good example is the use of Decision Model and Notation (DMN) for decision automation apps. DMN can be used to model decisions graphically in a decision requirements diagram. The approach works with commonly used techniques and simply accelerates the use of decision models. For example, many businesses define automation rules in a spreadsheet. Rather than reading and plowing through an enormous XML file that encodes the automation rules, DMN lets a developer or business analyst model a decision service graphically in a decision requirements diagram (DRD). This diagram consists of one or more decision requirements graphs (DRGs) that trace decision logic from start to finish.

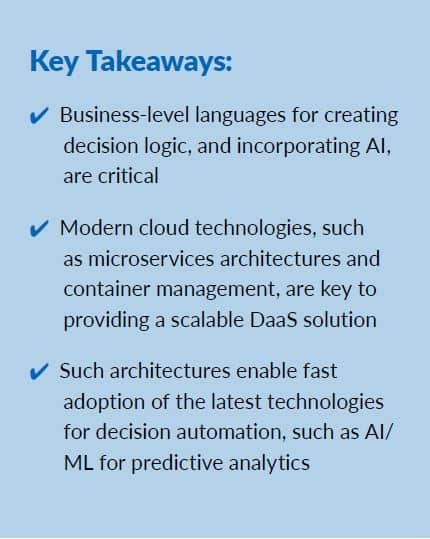

With these capabilities, DMN eliminates coding to help speed development of decision automation applications. But even more can be done to improve the development and delivery process. Specifically, what many businesses find is that they must move to more of a Decision Automation-as-a-Service (DaaS) approach to provide simple access, implementations and maintenance over distributed environments.

The ultimate goal is to have a managed solution for DaaS that offers a holistic, intuitive, streamlined experience for users that hides all operational complexities yet delivers true decision automation.

Elements of a Modern Decision Automation Strategy

Building decision automation

Such an approach is needed because decision automation is complex. There needs to be in essence an abstraction that hides the complexity of the underlying technologies. The business side does not need to learn to code and the developer side does not need to become experts in business decisions. A solution that lets both sides contribute to an application without mastering the other’s domain is critical to meet demands.

But more is needed to support a scalable solution, such as a DaaS. Given the need for great flexibility in the way decision automation applications are developed, run, and maintained, a DaaS needs a containerized microservices-based architecture to automate business decisions.

Additionally, a containerized architecture provides the flexibility that enables a DaaS to accommodate new technology as it is required. That means a company can make use of AI or ML, for example, without having to tear up an entire application or recode it from scratch.

Leveraging cloud-native business automation tools

Going beyond the basic benefits of using a cloud-native approach, there is a need for tools that help businesses react faster and allow business executives and developers to easily work together to build, deploy, and

Kogito is a cloud-native development, deployment, and execution

platform for building intelligent applications.

Kogito includes support for Decision Model and Notation (DMN) and can be used to model a decision service graphically in a decision requirements diagram (DRD). Such tools let both developers and business executives quickly build cloud-native applications that automate complex business decisions. Besides DMN, there are Kogito process management tools for Business Process Model and Notation (BPMN) and Case Management Model and Notation (CMMN).

The Need for Trust and Explainability

Automating decisions with AI can deliver many business benefits. But can the decisions be trusted? The training data used to develop a predictive model may contain unknown biases, and most machine-learned models arrive at a conclusion without any explanation of how they got there. This is in contrast to more traditional business rules approaches to decision automation, where an audit log of the specific rules that led to a decision is typically available.

Instill trust by verifying underlying model assumptions

There are several problems with a ‘blind faith’ approach to decision automation. Are the assumptions valid? Were the machine learning models trained on data that no longer represents the current state of the world? If a model were developed using a certain dataset and the data changes, what would the implications be on the decision?

Problems arise when the wrong or outdated machine

learning models are used to make the decisions.

A perfect example of what can happen is the impact of COVID-19 on financial models. Take a model that tries to predict customer payment waiver requests. The normal distribution for those requesting one, two, or three waivers fits certain distribution patterns. Do these patterns hold up under economic conditions seen as a result of the pandemic? (In March 2020, more than 40 million people filed unemployment claims in the U.S., global stock markets suffered dramatic falls, and the Dow Jones reported its largest-ever single-day fall of almost 3,000 points.) Without detailed knowledge of the model’s workings, there is no way to convey a level of confidence in the predictions.

Issues can arise even for decisions that are not dependent on such rapid data changes. A common problem that can occur in many decision automation efforts is model or data drift. If a model was trained on one set of data and that data changes gradually over time, the inferences made would no longer be correct. An extreme example of this would be developing a clothing recommendation engine for an online retail site using historical customer preferences and real-time data from clickstreams, social media influencers, and other sources. If the model was developed using data from the winter months, the recommendations in the summertime would not be applicable.

Eliminate bias to avoid legal and public relations disasters

Another transparency issue is bias. Not fully knowing what went into a model can lead to skewed or invalid results. One example that got extensive coverage happened when Apple launched its credit card. CNN reported that Apple offered tech entrepreneur David Heinmeier Hansson 20 times the credit limit as his wife even though they shared assets and she had a higher credit score. Apple co-founder Steve Wozniak had a similar experience with the card.

In all cases, what’s needed is Explainable AI, or XAI, which is the concept of understanding what is happening “under the hood” of the models and not just taking the most accurate model and blindly trusting its results. A properly implemented DaaS strategy would incorporate explainability into its services. XAI:

- instills trust in the decisions automatically being made by software

- helps assure there is no bias in the models

- provides insights into why decisions are made to justify automatic actions

Measuring Automation’s Impact

Real-time metrics can illustrate the business value of decision automation

A well-executed decision automation strategy brings benefits to a business in several areas. At the simplest level, decision automation saves time and resources. By streamlining information gathered from all steps in the workflow and using artificial intelligence to choose a course of action, automation lets businesses make informed decisions. Complex operations that would have required someone with years of expertise can be carried out by anyone in the organization who knows how to run the software. Automation also reduces human error and saves time by centralizing the process.

Keep tabs on performance with operational monitoring

In addition to such operational efficiencies, decision automation can have many other impacts on the business. An automated fraud prevention application that cuts off suspect transactions in real-time before they are executed saves the immediate financial loss that would have occurred. But it also avoids negative publicity, loss of company reputation, fines from regulatory bodies, and prevents the need for costly reparations.

Decision automation may also bring in new business or drive revenue growth. A broker might automate the selling of insurance, or an online retailer might speed decisions related to customer credit approvals or product recommendations.

Decision automation speeds such transactions,

off-loads work from employees, and increases revenue.

Correlating the effectiveness of decision automation to such business gains is not a straightforward proposition. The processes are complex and involve many systems. What’s needed are ways to monitor operational and business metrics and then tie them back to the decision automation process.

Understand outcomes for better insights

Such capabilities are possible in a DaaS strategy/implementation that tightly integrates auditing and monitoring into the decision automation process. Specifically, what is needed are:

-

Real-time monitoring services for operational and business metrics: These services let businesses monitor the decision-making to ensure it is correct. Also needed is a service that displays business metrics based on model decisions and provides execution monitoring for the decisions. Such information gives business analysts and developers insights into decision processes and allows them to monitor for risk.

-

Real-time monitoring service of operational metrics: Having this information provides execution monitoring for the decisions. It also gives developers a way to check for correct deployment and system health.

-

Auditing to trace decision execution: Such capabilities let the business inspect each individual decision made within the system and deliver model metadata for auditing purposes.

-

Explainability for each decision: Such a feature or service would help a business say why a decision was made, further helping with the accountability of the system.

Best Practices, Use Cases, and Examples

A DaaS Platform offers businesses an alternative to developing one-off decision automation applications from scratch. A platform approach reduces development costs and offers flexible solutions that the entire organization can use.

This is an area where Red Hat can help. Red Hat Decision Manager is an open-source decision automation platform. It enables business and IT users to create, manage, validate, and deploy business decision applications. To accomplish this, Decision Manager combines:

- Business rules management

- AI/ML integration

- Resource planning

It includes everything business users need to model business decision logic: Decision Model and Notation (DMN) models, Decision Tables and domain-specific rule languages. Use cases by customers cover a wide range of decision automation scenarios.

Decision Manager can be used for common decision automation use cases, including credit decisions, age classification, and fraud detection.

Decision automation use cases

Jupiter Telecommunications Co, Ltd. (J:COM) deployed Red Hat Decision Manager to automate and optimize its field service operations, helping the company to reduce costs and increase the efficiency of its workforce. This has not only helped the company improve customer experience but also be more strategic and consistent in how it schedules its mobile workforce. In addition, various elements that were required for routine work are now able to be visualized in the system, enabling the company to identify potential issues that can be proactively addressed through additional finetuning of the rules.

The Government of the State of Jalisco’s IT environment was dependent on outdated, expensive, and risk-prone proprietary software. To modernize the delivery of public services for its citizens, the state needed to standardize on a reliable infrastructure. By digitizing 60% of its services, the state can more effectively collect taxes, leading to a significant boost in revenue. Also, the government can now scale resources to meet citizens’ needs during times of peak demand, like tax season. Through more efficient resource use, the state has reduced infrastructure costs by 60% and hardware costs by 100%.

As these examples demonstrate, Decision Manager provides both business and IT users with a low-code solution that can reduce the time required to build applications that automate business decisions, enforce business policies, and ensure compliance with regulations.